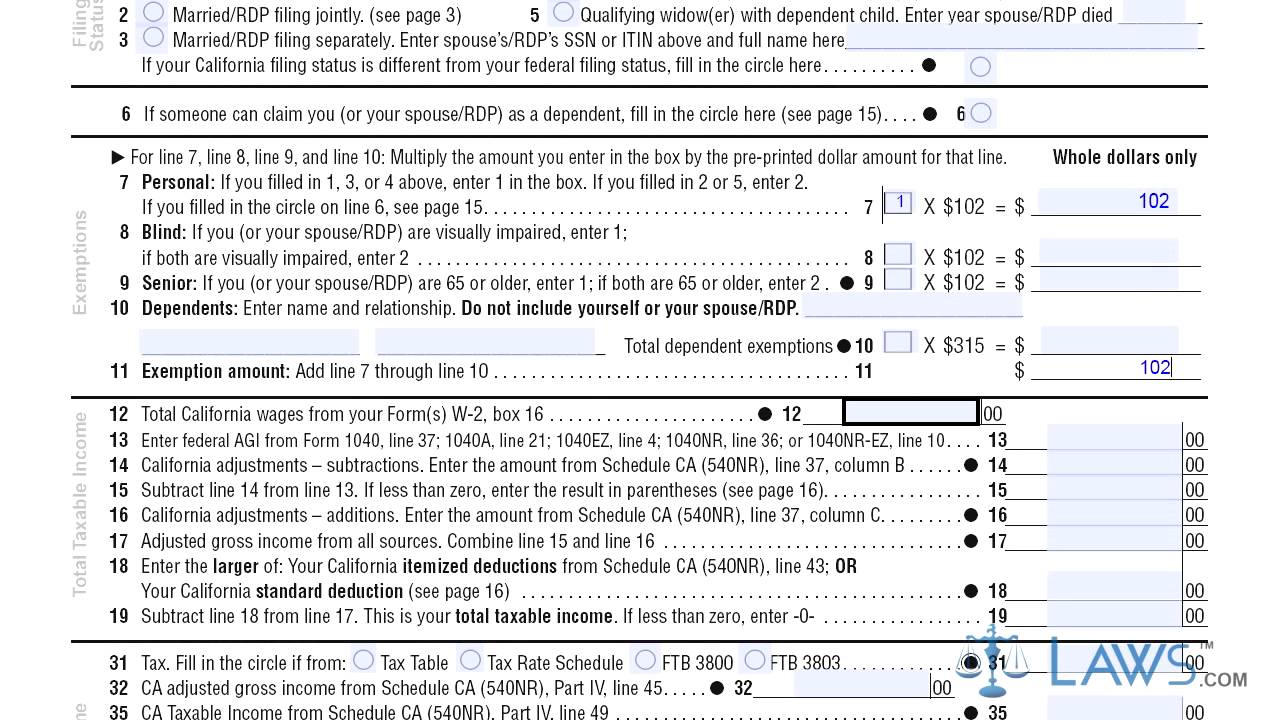

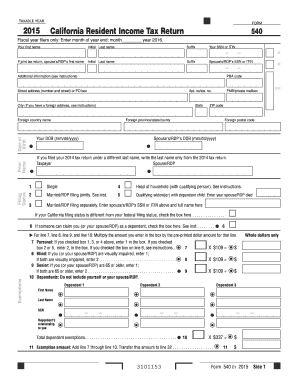

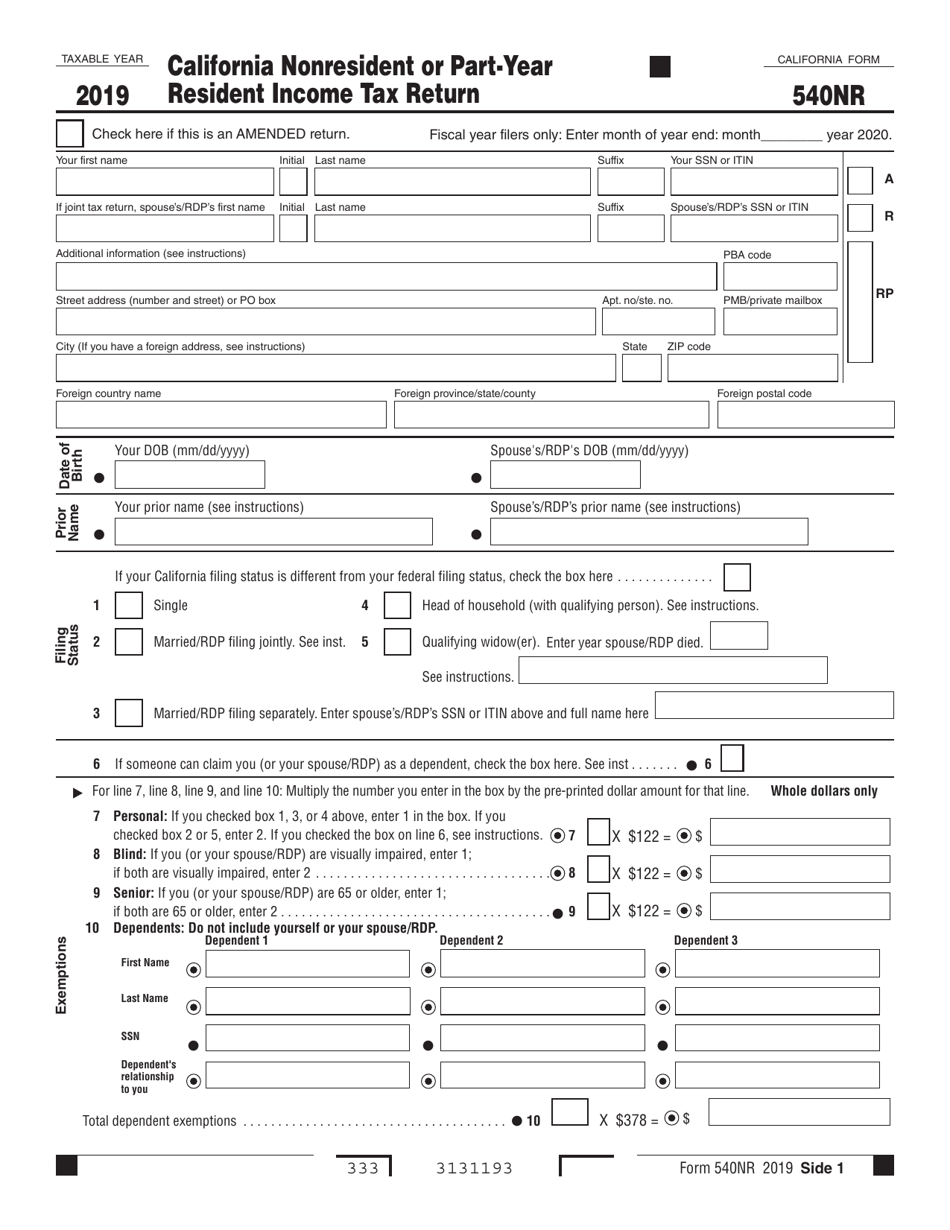

CVRP switches to requesting a new tax filing year for applications submitted the day after the federal income tax filing due date.įor applications submitted using the 2020 or 2021 tax year, the Administrator will review the following sections of an applicant’s federal tax return as reflected on their IRS tax transcript to help determine gross annual income: CVRP considers an applicant’s most recent federal tax return to be the one most recently required to be filed by the IRS. Wages, unemployment, workers' compensation, Social Security, Supplemental Security Income, public assistance, veterans' payments, survivor benefits, pension or retirement income, interest, dividends, rents, royalties, income from estates, trusts, educational assistance, alimony, child support, assistance from outside the household, and other miscellaneous sources.Īn applicant’s most recent federal tax return (as reflected on their IRS tax transcript) or other proof of income documentation as determined by the administrator may be used to help calculate gross annual income. This includes, but is not limited to, the following. Gross Annual Income Definitionįor the purposes of CVRP, gross income includes both taxable and non-taxable income sources. The next scheduled updates to CVRP governing documents can be found in the CVRP FAQs. These governing documents are updated several times every year and changes may impact how an applicant’s income is calculated, and therefore the applicant’s eligibility for the program.

#2019 california tax table manual#

Both the Terms and Conditions and Implementation Manual in place at the time of application submission will determine the applicant’s eligibility for the program.

Income eligibility requirements were introduced to the program for individual applications on March 29, 2016.Īt the time an applicant submits a signed application for a rebate, the most current CVRP Implementation Manual available, as well as the Terms and Conditions signed by the applicant, will apply. Eligibility will be reviewed based on the Terms and Conditions in place at the time a new application is submitted. Applications received prior to the date of purchase/lease as stated above will be canceled, and applicants will need to reapply. Applicants submitting a post-purchase application must have taken delivery of their vehicle before submitting an application.

#2019 california tax table registration#

†For Tesla and other vehicles ordered without a standard lease/purchase agreement, the date of first registration with the California DMV will be considered the date of purchase or lease. Additionally, a trust is not considered a business and any vehicle purchased through a trust will be processed as an individual application and the individual submitting the application on behalf of the trust is subject to income requirements. *Sole proprietorships and DBAs (doing business as also called fictitious business name, assumed business name or trade name) cannot apply as a business and must instead apply as an individual. The anticipated date for the next changes to CVRP governing documents can be found in the CVRP FAQs. These governing documents are updated several times every year and changes may impact the applicant's eligibility for the program. Both the Terms and Conditions and Implementation Manual, in place at the time of application submission, will determine an applicant's eligibility for the program.

0 kommentar(er)

0 kommentar(er)